Equity research White Pearl Technology Group: First impression, Q3 2025 – Strong EBITDA margin

5 Nov 2025

Today, White Pearl Technology Group published its interim report for Q3 2025. Below is a compilation of our first impressions of the outcome, including deviations from our estimates. The company will host a webcast with a telephone conference today at 2 p.m.

White Pearl’s sales figures increased by 52 per cent in line with the communication in the preannouncement on 28 September. Operating profit increased by 81 per cent, underpinned by expanding margins. This far exceeded our somewhat conservative forecast, implying better revenue mix and scalability than anticipated.

The company also generally reiterates its financial targets from the September preannouncement. This includes a projection to exceed the previous (from the Q2 2025 report) FY 2025 target of SEK 470m by 5-10 per cent. However, there are no further comments on the 2026-2028 targets. We expect a positive initial share reaction following the substantial margin uptick.

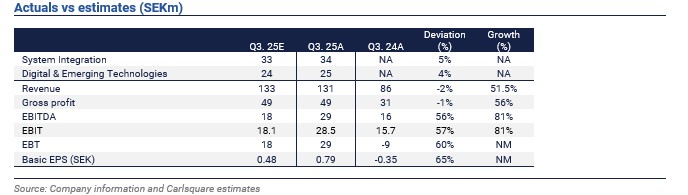

- In Q3 2025, White Pearl Technology Group reported net sales of SEK 131m, corresponding to a 52% growth. Our forecast for the quarter was SEK 133m.

- The main deviation was lower revenue in the People Solutions/BPO segment, mitigated by solid development, e.g., in the Systems Integration and Digital & Emerging Technologies segment. We believe this overall implies organic growth at the upper end of our expectations.

- Gross profit calculated on net sales increased by 56% to SEK 49m. Our forecast was SEK 49m.

- Reported EBITDA increased 81% to SEK 29m, corresponding to a margin of 21.8%. Our forecast was SEK 18m, equivalent to a margin of 13.7%. The main deviation from our forecast is lower OPEX than expected.

We intend to provide a research update on White Pearl Technology Group shortly. Read the last research update report here.

Disclaimer

Carlsquare AB, www.carlsquare.se, hereinafter referred to as Carlsquare, is engaged in corporate finance and equity research, publishing information on companies and including analyses. The information has been compiled from sources that Carlsquare deems reliable. However, Carlsquare cannot guarantee the accuracy of the information. Nothing written in the analysis should be considered a recommendation or solicitation to invest in any financial instrument, option, or the like. Opinions and conclusions expressed in the analysis are intended solely for the recipient.

The content may not be copied, reproduced, or distributed to any other person without the written consent of Carlsquare. Carlsquare shall not be liable for either direct or indirect damages caused by decisions made on the basis of information contained in this analysis. Investments in financial instruments offer the potential for appreciation and gains. All such investments are also subject to risks. The risks vary between different types of financial instruments and combinations thereof. Past performance should not be taken as an indication of future returns.

The analysis is not directed at U.S. Persons (as that term is defined in Regulation S under the United States Securities Act and interpreted in the United States Investment Companies Act of 1940), nor may it be disseminated to such persons. The analysis is not directed at natural or legal persons where the distribution of the analysis to such persons would involve or entail a risk of violation of Swedish or foreign laws or regulations.

The analysis is a so-called Assignment Analysis for which the analysed company has signed an agreement with Carlsquare for analysis coverage. The analyses are published on an ongoing basis during the contract period and for the usually fixed fee.

Carlsquare may or may not have a financial interest with respect to the subject matter of this analysis. Carlsquare values the assurance of objectivity and independence and has established procedures for managing conflicts of interest for this purpose.

The analysts Niklas Elmhammer and Christopher Solbakke do not own and may not own shares in the analysed company.