Equity research Zinzino Q2 2025: Subscribing to rapid growth

2 Sep 2025

Read the full update here

The operating margin was somewhat lagging in another quarter of breakneck growth (+57 per cent) as, for example, costs for opening new markets picked up. However, cash flow was robust, and the expansion in new and existing markets bodes well for improving profitability in the medium term through a growing base of subscriptions and other recurring revenue. While margins vary between individual quarters, Zinzino is executing well ahead of the curve.

Expansion costs hampered margins in a busy quarter

In line with the sales pre-announcement on 3 July, Zinzino reported revenue growth of 57% in Q2 2025. This was driven by solid sales momentum across most regions, including core markets such as Central Europe and North America, as well as Asia-Pacific. The CEO is hopeful for around 50% growth for 2025, well above the financial target of 20% growth on average. For H1 2025, growth was 58%, and a total revenue growth of 55% in July supports this view.

Margins in Q2 2025 were lower than our forecast, which was related to higher OPEX than we had assumed. Zinzino mentions increased costs associated with acquisitions and the opening of new markets, most recently China, New Zealand, and the Philippines. In addition, non-cash currency translation effects impacted EBITDA for the quarter by SEK -10.0 (-0.2) million. Hence, operating leverage was lower compared to the previous quarter. However, Zinzino has historically successfully turned “growth investments” into increased sales. The gross margin decreased by 3.2 percentage points to 31.2% vs our forecast of 31.5%. We believe this demonstrates that Zinzino has a reasonable balance between growth and earnings.

“Supplements as a Service” business supports a healthy outlook

Zinzino’s business model is based on generating a high share of recurring revenue, at least 60%, from subscriptions and returning customers. This is facilitated by orders being placed online. While churn is significant, the model generates a rising base of recurring revenue and strong cash flows even as the company grows. It also provides good visibility, generates important data and facilitates planning and efficiency. As a result, we see reason for the good growth to continue in 2026, further underpinned by M&A and Zinzino having entered new markets.

Strong growth and operating cash flow motivate a premium valuation

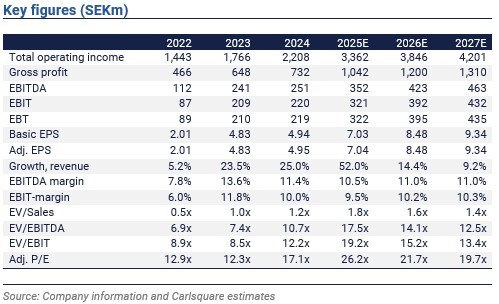

We adjust our estimates for slightly higher operating costs, better alignment with company guidance and other minor assumption updates. As a result, we lower our EBITDA expectations by about six per cent on average for 2025E-2027E.

Consequently, we lower the base case valuation. This corresponds to an EV/EBIT 2026E of 20-21x. Solid growth prospects and a high share of subscription-based revenue justify a premium versus peers.

Disclaimer

Carlsquare AB, www.carlsquare.se, hereinafter referred to as Carlsquare, conducts business with regard to Corporate Finance and Equity Research in which areas it, among other things, publishes information about companies including analyses. The information has been compiled from sources that Carlsquare considers to be reliable. However, Carlsquare cannot guarantee the accuracy of the information. Nothing written in the analysis should be regarded as a recommendation or invitation to invest in any financial instrument, option or the like. Opinions and conclusions expressed in the analysis are intended only for the recipient.

The content may not be copied, reproduced or distributed to another person without the written approval of Carlsquare. Carlsquare shall not be held responsible for any direct or indirect damage caused by decisions made on the basis of information contained in this analysis. Investments in financial instruments provide opportunities for value increases and profits. All such investments are also subject to risks. Risks vary between different types of financial instruments and combinations of these. Historical returns should not be considered as an indication of future returns.

The analysis is not directed to US persons (as defined in Regulation S of the United States Securities Act and interpreted in the United States Investment Company Act 1940) nor may it be disseminated to such persons. The analysis is also not directed to such natural and legal persons where the distribution of the analysis to such persons would result in or entail a risk of a violation of Swedish or foreign law or constitution.

The analysis is a so-called Commissioned Research Report where the analysed company has signed an agreement with Carlsquare for analysis coverage. The analyses are published on an ongoing basis during the contract period and for a usual fixed remuneration.

Carlsquare may or may not have a financial interest in the subject of this analysis. Carlsquare values the assurance of objectivity and independence and has established procedures for managing conflicts of interest for this purpose.

The analyst Niklas Elmhammer and Markus Augustsson does not own and is not allowed to own shares in the company analysed.