Equity research Svenska Aerogel, Q3 2025: Better than expected profitability

24 Oct 2025

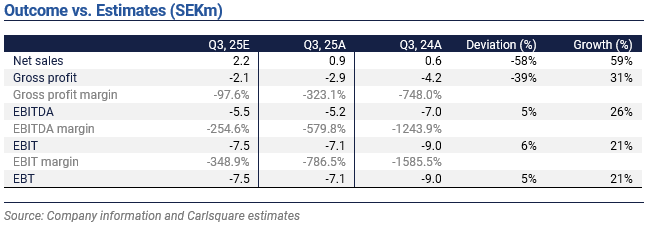

Today, Svenska Aerogel published its interim report for Q3 2025. Below is a summary of our first impressions of the report’s outcome and the income statement’s deviations from our forecasts.

- Net sales for Q3 2025 amounted to SEK 0.9 million, representing a 59% increase compared to Q3 2024. Our estimate of SEK 2.2 million in net sales was therefore significantly higher than the actual outcome. However, the rolling 12-month sales continue to increase and amounted to approximately SEK 4.5 million at the end of Q3 2025.

- EBIT amounted to negative SEK 7.1 million. The Company’s EBIT estimate was negative SEK 7.5 million. The difference is attributable to lower-than-expected costs for goods sold and administration, and the Company achieved better profitability than expected despite low revenue.

- The net result for Q3 2025 amounted to minus SEK 7.1 million, compared to our estimate of minus SEK 7.5 million.

During Q3 2025, the Company received a new container order of 2 tons from a North American customer in the thermally insulated outdoor products segment. Within the Building & Construction segment, the Italian customer Isoltech achieved a breakthrough in cellular concrete, where the new material demonstrated superior performance compared to the current market leader in terms of both thermal insulation and quality, according to CEO Tor Einar Norbakk.

We intend to publish a full research update of Svenska Aerogel shortly.

Disclaimer

Carlsquare AB, www.carlsquare.se, hereinafter referred to as Carlsquare, is engaged in corporate finance and equity research, publishing information on companies and including analyses. The information has been compiled from sources that Carlsquare deems reliable. However, Carlsquare cannot guarantee the accuracy of the information. Nothing written in the analysis should be considered a recommendation or solicitation to invest in any financial instrument, option, or the like. Opinions and conclusions expressed in the analysis are intended solely for the recipient.

The content may not be copied, reproduced, or distributed to any other person without the written consent of Carlsquare. Carlsquare shall not be liable for either direct or indirect damages caused by decisions made on the basis of information contained in this analysis. Investments in financial instruments offer the potential for appreciation and gains. All such investments are also subject to risks. The risks vary between different types of financial instruments and combinations thereof. Past performance should not be taken as an indication of future returns.

The analysis is not directed at U.S. Persons (as that term is defined in Regulation S under the United States Securities Act and interpreted in the United States Investment Companies Act of 1940), nor may it be disseminated to such persons. The analysis is not di-rected at natural or legal persons where the distribution of the analysis to such persons would involve or entail a risk of violation of Swedish or foreign laws or regulations.

The analysis is a so-called Assignment Analysis for which the analysed company has signed an agreement with Carlsquare for analysis coverage. The analyses are published on an ongoing basis during the contract period and for the usually fixed fee. Carlsquare may or may not have a financial interest with respect to the subject matter of this analysis. Carlsquare values the assurance of objectivity and independence and has established procedures for managing conflicts of interest for this purpose.

The analysts Christopher Solbakke and Bertil Nilsson do not own and may not own shares in the analysed company.