Equity research Viva Wine Group: Preview Q3 2025 – A glass half full in a slow market

28 okt 2025

Viva Wine Group (the company or Viva) will release its Q3 2025 report on 20 November 2025. Below are Carlsquare Equity Research’s updated estimates ahead of the report.

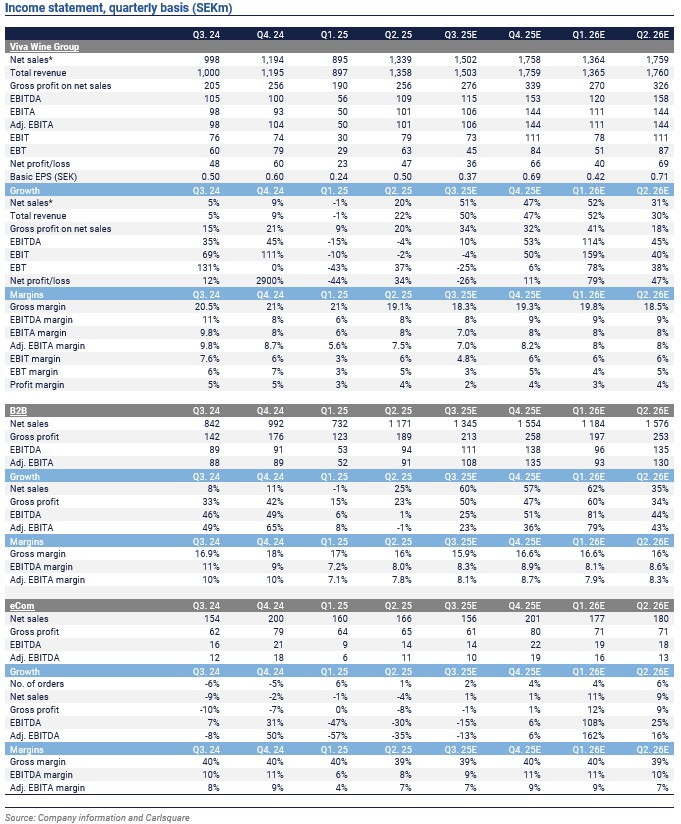

- Based on data from Nordic monopolies, we estimate that those markets have developed in a similar pattern as the previous quarter, i.e. somewhat lower volumes y-o-y. It appears that a slow August was the main drag, likely related to the cool weather. Despite the market headwinds, we expect somewhat better momentum for Viva Wine’s B2B segment compared to H1.

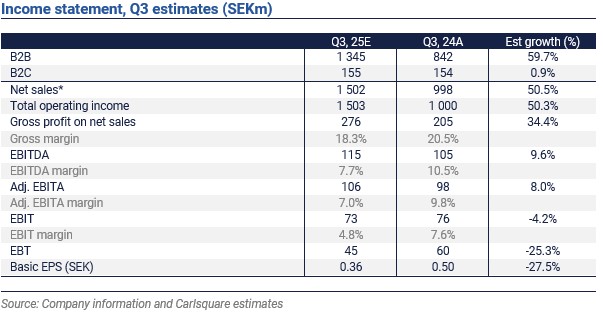

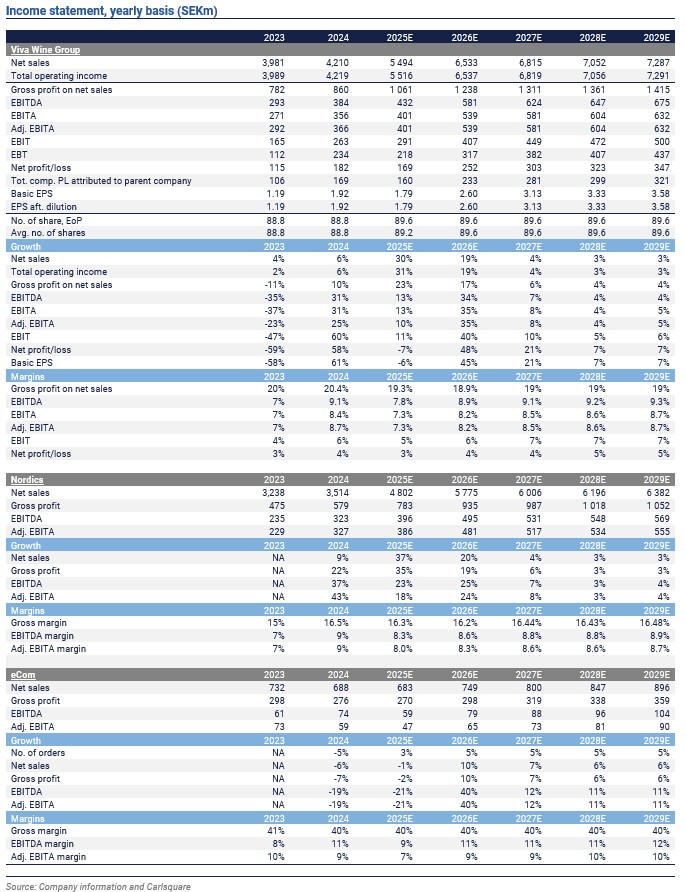

- The acquisition of Delta Wines will significantly boost sales (we assume some 49 per cent) and also contribute to an overall earnings increase, we believe. The positive impact was partly visible in Q2 2025, with sales and EBITA contributions of SEK 233m and SEK 9m, respectively. However, for the Nordics B2B operations and the B2C segment, we expect lower profitability year over year due to sluggish volumes and higher OPEX. For the group, we expect an adjusted EBITA of SEK 106m (98), corresponding to a margin of 7.0% (9.8).

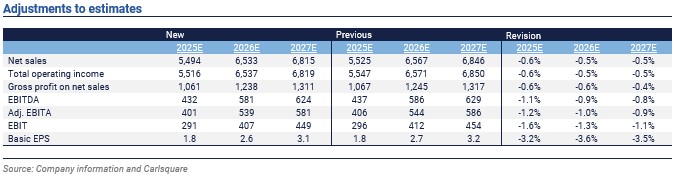

- We have become slightly more cautious regarding organic growth for the full year due to continued lacklustre markets in Q3. Hence, we adjust our earnings estimates lower by about one per cent overall. However, we do not foresee any major changes to our current base case valuation of SEK 50 per share in conjunction with the Q3 report on 20 November.

- We believe that Viva Wine Group has strengthened its position through organic growth and acquisitions in recent times and is well placed to continue to outperform its target markets over time. With the previous valuation premium compared to peers now apparently gone (see below), it suggests good rerating potential when the market shows signs of recovery, barring any unexpected setbacks related to, e.g., the integration of Delta Wines.

Read the latest research update here.

Disclaimer

Carlsquare AB, www.carlsquare.se, hereinafter referred to as Carlsquare, is engaged in corporate finance and equity research, publishing information on companies and including analyses. The information has been compiled from sources that Carlsquare deems reliable. However, Carlsquare cannot guarantee the accuracy of the information. Nothing written in the analysis should be considered a recommendation or solicitation to invest in any financial instrument, option, or the like. Opinions and conclusions expressed in the analysis are intended solely for the recipient.

The content may not be copied, reproduced, or distributed to any other person without the written consent of Carlsquare. Carlsquare shall not be liable for either direct or indirect damages caused by decisions made on the basis of information contained in this analysis. Investments in financial instruments offer the potential for appreciation and gains. All such investments are also subject to risks. The risks vary between different types of financial instruments and combinations thereof. Past performance should not be taken as an indication of future returns.

The analysis is not directed at U.S. Persons (as that term is defined in Regulation S under the United States Securities Act and interpreted in the United States Investment Companies Act of 1940), nor may it be disseminated to such persons. The analysis is not directed at natural or legal persons where the distribution of the analysis to such persons would involve or entail a risk of violation of Swedish or foreign laws or regulations.

The analysis is a so-called Assignment Analysis for which the analysed company has signed an agreement with Carlsquare for analysis coverage. The analyses are published on an ongoing basis during the contract period and for the usually fixed fee.

Carlsquare may or may not have a financial interest with respect to the subject matter of this analysis. Carlsquare values the assurance of objectivity and independence and has established procedures for managing conflicts of interest for this purpose.

The analysts Niklas Elmhammer and Markus Augustsson do not own and may not own shares in the analysed company.