Equity Research Enrad, Q3 2025: Strong quarter above expectations

6 Nov 2025

Enrad AB’s net sales of SEK 12.6 million in Q3 2025 exceeded our estimate of SEK 11.2 million by approximately 12%. Compared to Q3 2024, sales grew by 57%. Profit margins also came in higher than we had anticipated.

Breakthrough in the Netherlands can happen in Q4

Enrad AB (“Enrad” or “the Company”) reported net sales of approximately SEK 12.6 million in Q3 2025, which was about 12% higher than our estimate of SEK 11.2 million. The gross profit of SEK 6.6 million corresponds to a gross margin of 52.5%, exceeding our estimate of a gross profit of SEK 5.8 million and a gross margin of 52%. EBITDA amounted to negative SEK 0.3 million in Q3 2025, compared to our estimate of negative SEK 0.7 million. The deviation is primarily attributable to higher-than-expected sales. The Company’s cash position as of September 30, 2025, amounted to approximately SEK 20.0 million.

In the Q3 2025 report, CEO Andreas Bäckäng stated that the establishment in the Netherlands has been a key focus during the quarter. A recently signed partnership with One Solution in Holland BV is expected to accelerate market penetration. The current focus is on converting interest into confirmed orders, with the goal of securing the first deal before year-end.

Meanwhile, progress continues within the product and production areas. Organizational changes in Norway have freed up resources for product development and technical improvements. Certain decisions regarding new products are pending the update of industry standards to ensure full compliance with future requirements. The work to streamline production processes has intensified following the digitalization implemented earlier this year, with the goal of optimizing workflows and operational efficiency.

The Company has also initiated the development of its own training and certification platform for refrigeration technicians—a strategic initiative aimed at securing future competence in natural refrigerants. This is expected to strengthen the Company’s competitiveness over time.

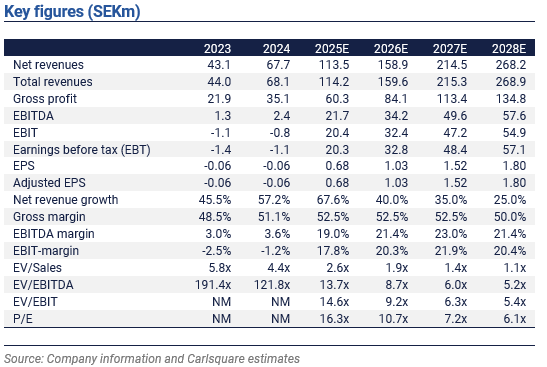

We are making a slight upward revision to our net sales estimate for Enrad in 2025, from the previous SEK 64.3 million to SEK 67.7 million. Forecasts for 2026 and 2027 have also been adjusted slightly upwards. We assume a gross margin of around 50% for the period 2025–2028, gradually declining to 45% toward the end of the estimation period in 2034.

Disclaimer

Carlsquare AB. www.carlsquare.se. hereinafter referred to as Carlsquare. carries out activities within corporate finance and equity research and publishes. among other things. information on companies. including analyses. The information is based on sources that Carlsquare believes to be reliable. However. Carlsquare cannot guarantee the accuracy of the information. Nothing contained in the analysis should be construed as a recommendation or solicitation to invest in any financial instrument. option or the like. Opinions and conclusions expressed in the analysis are intended only for the recipient.

The content may not be copied. reproduced. or distributed to third parties without the written consent of Carlsquare. Carlsquare shall not be liable for any direct or indirect damage resulting from decisions taken based on the information contained in this analysis. Investments in financial instruments offer opportunities for capital appreciation and profits. All such investments also involve risks. Risks vary between different types of financial instruments and combinations thereof. Past performance should not be taken as an indication of future results.

The analysis is not directed at. and may not be distributed to. U.S. persons (as that term is defined in Regulation S under the U.S. Securities Act of 1933. as amended (the “Securities Act”)). The analysis is also not directed at any natural or legal person in any jurisdiction where the distribution of the analysis to such persons would constitute or risk a violation of any Swedish or foreign law or constitution.

The analysis is so-called Commissioned Research. where the analyzed company has signed an agreement with Carlsquare about the analysis coverage. The analyses are published on an ongoing basis during the contract period and for the usual fixed fee.

Carlsquare may or may not have a financial interest in what is the subject of this analysis. Carlsquare is committed to ensuring objectivity and independence and has established procedures for dealing with conflicts of interest.

The analysts Christopher Solbakke and Bertil Nilsson do not own and may not own shares in the company analysed.