Equity research, White Pearl Technology Group: A hidden gem among the tech companies

21 Août 2025

Read the full initial coverage report here:

White Pearl is a technology group delivering IT solutions that power global digital transformation. With a strategic focus on emerging technologies, proprietary IP, and recurring software revenues, the Group has achieved strong growth alongside improved profitability. However, despite solid fundamentals, the share continues to trade at an unjustified discount.

White Pearl, a platform for digital transformation with proven abilities

White Pearl Technology Group AB (“White Pearl”, the “Group”, the “Company”, or “WPTG”) has rapidly developed into an international end-to-end IT solutions provider, helping clients build, transform, and optimise their operations. The Company operates through 37 independently managed yet integrated subsidiaries across more than 30 countries, focusing on high-growth, underserved emerging markets such as Africa and the Middle East. This positions WPTG to seize growth opportunities while effectively managing both operational and geographical risk.

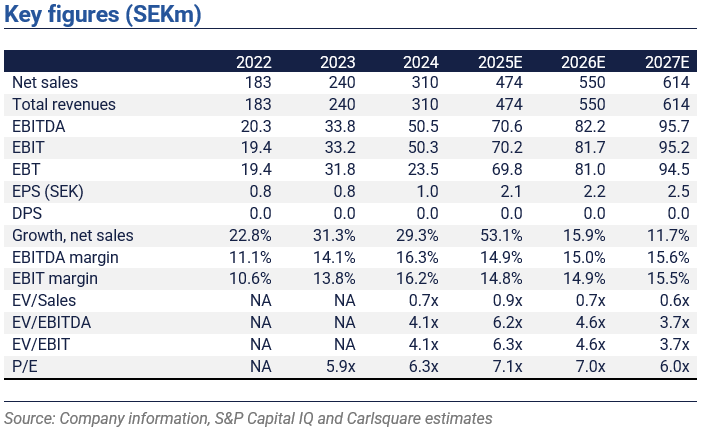

White Pearl has demonstrated its ability to capitalise on rising demand for digital transformation, underpinned by core strengths in areas such as artificial intelligence (“AI”), cybersecurity, and automation: Between 2022 and 2024, White Pearl achieved an impressive revenue CAGR of 32%, driven by strong market relevance that delivered organic growth rates ranging from 14% to 69%, alongside the successful execution of a targeted acquisition strategy. Over the same period, the EBITDA margin increased from 11.0% in 2022 to a robust 16.3% in 2024. The margin expansion has been driven by a strategic shift towards high-margin, IP-led solutions built on emerging technologies, such as AI.

Strong growth and margin momentum is expected to continue

Following continued strong financial performance in H1 2025, we project full-year revenue of SEK 474 million, representing a 53% year-on-year increase, with approximately 30% driven by organic growth. We also expect EBITDA to increase by 40% to SEK 71 million, corresponding to a margin of 14.9%. This is in-line with the Company’s target of revenue of SEK 470 million and an EBITDA result of SEK 72 million. For the upcoming five years, 2025-2029, we estimate a revenue CAGR of 18.8%. We also project the EBITDA margin to rise to 16.8% by 2029, driven by a shift in the revenue mix towards the high-margin Digital & Emerging Technologies segment. This is below the Company’s target regarding both growth and margins. However, our projections do not include the impact of any future potential acquisitions. M&A is a potential trigger.

Undeserved discount despite solid historical development and outlook

Despite the recent rally, the share is currently trading at an EV/EBIT NTM multiple of 5.9x and P/E NTM of 7.7x, an undeservedly large discount given the financial performance to the Nordic reference group medians of 10.9x and 15.2x, respectively. Our fair value per share of SEK 21.0, for the upcoming six months, corresponds to an EV/EBIT NTM of 8.1x and P/E NTM of 10.7x. In terms of P/E NTM, our fair value represents a discount of 30% to Nordic Peers. The discount is reasonable considering exposure to more volatile emerging markets, which is usually associated with a discount of 20-40%.

Disclaimer

Carlsquare AB. www.carlsquare.se, hereafter referred to as Carlsquare, conducts operations in Corporate Finance and Equity Research and thereby publishes information about companies, including analyses. The information has been compiled from sources that Carlsquare considers reliable. However, Carlsquare cannot guarantee the accuracy of the information. Nothing written in the analysis should be regarded as a recommendation or invitation to invest in any financial instrument, option or similar. Opinions and conclusions expressed in the analysis are intended solely for the recipient.

The content may not be copied, reproduced, or distributed to any other person without the written consent of Carlsquare. Carlsquare shall not be liable for any direct or indirect damage caused by decisions made based on information contained in this analysis. Investments in financial instruments provide opportunities for capital appreciation and profits. All such investments are also associated with risks. The risks vary between different types of financial instruments and combinations thereof. Historical returns should not be considered as an indication of future returns.

The research is not directed at U.S. Persons (as that term is defined in Regulation S of the United States Securities Act and interpreted in the United States Investment Companies Act 1940) and may not be distributed to such persons. Nor is the analysis aimed at such natural or legal persons where the distribution of the analysis to such persons would involve or entail a risk of violation of Swedish or foreign law or regulations.

The analysis is a so-called commissioned analysis where the analysed company has signed an agreement with Carlsquare for analysis coverage. The analyses are published continuously during the contract period and against customary fixed remuneration.

Carlsquare may or may not have a financial interest in the subject of this analysis. Carlsquare values ensuring objectivity and independence and has therefore established procedures for managing conflicts of interest.

The analysts Christopher Solbakke, Niklas Elmhammer, and Markus Augustsson do not and may not own shares in the analysed company.