Software’s crown is at risk — hardware is king again

6 Okt 2025

AI is rewriting the rules.

- Software development is being automated → faster time-to-market, more competition, and pressure on margins

- Hardware now offers real defensibility: supply chains, certification, deep integration and proprietary sensor/data assets

- The sweet spot? Hybrid models — hardware + software/services. Think wearables, connected devices, and AI-enabled platforms…

Thirty years ago, when I started out in the IT sector covering Ericsson and Nokia as an equity research analyst, hardware was everything. Software came bundled with the device; subscriptions didn’t exist. Over time hardware became commoditised, margins squeezed, and the industry moved to a software-first model. For years software firms — with recurring revenue and high margins — have traded at multiples far above traditional hardware businesses.

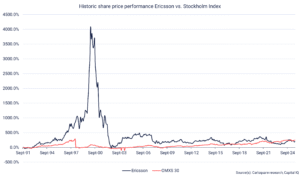

Historic share price perfomance Ericsson vs. Stockholm Index

Click to zoom

Until the bubble burst in 2000, it was the hardware companies that were in the driving seat. The above graph illustrates Ericsson’s long-term performance, including the exponential growth of its stock and subsequent crash.

The market is shifting again. Artificial intelligence is accelerating change across the stack, and that creates both threats and opportunities for hardware companies. If you’re an entrepreneur preparing for a sale or a PE buyer scanning for value, here is how I see the landscape — and how to act.

From “Weight by the Kilogram” to Recurring Revenue

Historically, hardware was priced like any physical commodity: margins were thin, and scale mattered. Software changed the game: recurring revenue, high gross margins and strong customer retention produced superior cash flows and valuation multiples.

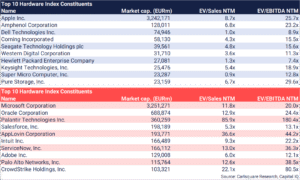

Index Performance Hardware vs. Software

Although the hardware sector has performed better since reaching a low point in 2017, it has been significantly outperformed by software companies. Since 2014, the value of software company shares has increased fivefold, whereas the value of hardware company shares has “only” increased twofold.

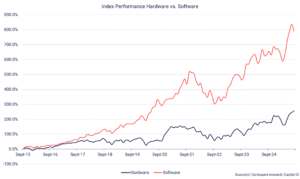

Forward EV/Sales Multiple Hardware vs. Software

Valuations are even tougher for hardware companies. Hardware companies have been trading steadily at two times sales over the last ten years. Meanwhile, software companies have grown much stronger, with valuations ranging from 4x to 12x. These are amazingly high valuations that seem unreachable for all other sectors of the stock market.

The reasons for this are high margins and recurring revenue. Growth makes these companies highly attractive to investors.

Carlsquare’s outreach initiatives exemplify this principle. We receive three to five times more interest when sending teasers about pure software companies than for blended companies (Software/Hardware).

Valuations are even tougher for hardware companies. Hardware companies have been trading steadily at two times sales over the last ten years. Meanwhile, software companies have grown much stronger, with valuations ranging from 4x to 12x. These are amazingly high valuations that seem unreachable for all other sectors of the stock market.

The reasons for this are high margins and recurring revenue. Growth makes these companies highly attractive to investors.

Carlsquare’s outreach initiatives exemplify this principle. We receive three to five times more interest when sending teasers about pure software companies than for blended companies (Software/Hardware).

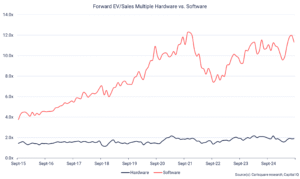

Forward EV/EBITDA Multiple Hardware vs. Software

Looking at profit, software companies were trading at 27 times EV/EBITDA at the 2021 peak. Since then, the group’s valuation has dropped slightly, but they are still trading at 23 times.

Hardware companies have generally been trading at between x10 and x12, but it is interesting that the gap is decreasing.

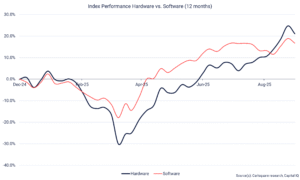

Index Performance Hardware vs. Software (12 months)

Zooming in on performance over the last year, we can see that hardware companies are actually outperforming software companies on the stock market. Although the margin is slight, we believe there is a reason for this trend to continue.

Why Software Has Commanded the Premium

Two core characteristics explain the premium for software:

- Recurring and predictable revenue (subscriptions, SaaS) that smooths cash flow and reduces perceived investment risk.

- High gross margins, which translate into more free cash flow per revenue dollar.

Those attributes are what PE firms value: predictability, scalability and exit optionality.

Why the Market Could Rebalance — and Faster Than You Think

AI is changing how software is created and deployed. The key threat is that it is becoming increasingly easy to compile software. Companies such as GitHub Copilot and Lullaby provide the tools that accelerate development. Mean time-to-market shrinks from months to days for many applications. That increases competition and puts downward pressure on software price points—especially in commoditised categories like ERP, call-center software, and certain vertical SaaS niches.

Three consequences follow:

- Margins may compress for software categories that become commoditised by AI automation. High valuation multiples are sensitive to even modest margin declines.

- New entrants with low development cost can flood markets, eroding pricing power for incumbents.

- Increased M&A consolidation as incumbents buy defensibility.

For PE firms and founders, this means that today’s highly-valued software business may face faster and deeper margin pressure than historical models anticipate.

When a new trend hits an industry, it is usually easier to build a company from scratch than to try to transform an existing one.

Of course, this will differ from company to company. For example, it may be easier to build an AI-powered call centre from scratch than to rebuild an existing company with all its associated costs.

We expect a wave of lower-cost AI-driven ERP entrants within 3–5 years; incumbents with deep integration and proprietary data will be hardest to displace. Business management software that integrates and automates core business processes such as finance, HR, production and sales using a central database will be the most likely to survive.

This will most probably transform the ERP market. The key here is how well the ERP systems from SAP or Oracle are integrated with clients’ other systems: the better the integration, the stronger the defence that ERP vendors will have. Nevertheless, it is still a defensive strategy. The winner will be the big ERP vendor who can take advantage of AI. Then we may see some new names in the industry that we have not heard of before.

The general trend will be downward pressure on prices, and margins can only be upheld if internal work with AI brings down costs and produces new revenue streams.

Hardware’s Defensive Advantage: “Real World” Moats

Hardware can’t be fully replicated by software and AI. Once a hardware product is designed and manufactured, the physical supply chain, manufacturing know-how, regulatory compliance, certification, and logistics create practical barriers to entry.

That doesn’t mean hardware is immune — but in several ways it’s harder for AI-driven upstarts to displace hardware incumbents immediately. Where hardware is closely paired with data and services (think connected devices with proprietary sensors and datasets), it creates stickier customer relationships.

Below are two examples of software companies that also offer hardware:

Oura’s ring is a leading consumer sleep/wellness device. Since the product was first offered in 2015, the company has announced that it has surpassed 5.5 million, according to the company. OURA is on track to double its revenue this year and reach USD 1 billion in sales by 2025, all the while continuing to increase its profitability.

The Oura Ring keeps track of your brain and body and is heavily data driven. However, the ring is the company’s perfect outer fence.

Click to zoom

OpenAI, the heavyweight champion in AI, will launch a hardware device. Rumours suggest it will be a smart speaker without a screen, but it’s anyone’s guess what it will actually be. Other possibilities under consideration include smart glasses, digital recording devices and wearable pins.

Semi-Software / Semi-Hardware: A New M&A Sweet Spot

This is where the “semi-software / semi-hardware” model becomes compelling.

If pure software is under competitive pressure and pure hardware is commoditised, the hybrid model is often the best of both worlds:

- Hardware offers a physical moat and product differentiation.

- Software and services deliver recurring revenue and upside multiples.

Examples of companies that combine both (and thus attract strong investor interest) include connected device makers with subscription analytics or device SaaS layers. Big tech players are also experimenting with hardware (and major AI players are exploring devices), which validates the strategic value of owning both product and platform.

What This Means for Sellers and PE Buyers

For entrepreneurs preparing to sell:

- Own the software story: Even if your core is hardware, build recurring service revenue (data subscriptions, support, SaaS features). Buyers value predictability.

- Quantify the moat: Document manufacturing advantages, certification, proprietary materials, supplier relationships, or exclusive data sets.

- Invest in integration: Demonstrate how your device integrates into customers’ workflows (APIs, connectors, partner ecosystem).

- Make AI work for you: Use AI to lower production costs, accelerate R&D, or to provide new monetisable services from device-collected data.

For PE firms evaluating targets:

- Value hybrid models: Target businesses where hardware creates defensibility and software unlocks recurring revenue.

- Stress-test margins under AI commoditisation: Model how price and margin compression in software could impact enterprise value.

- Look for integration moats: Companies with strong system integrations and proprietary data are harder to displace.

Likely Market Outcome — a Simple Rule of Thumb

From our own experience and observation, the industry will likely sort into three groups:

- Survivors & Innovators — firms that adopt AI, combine HW+SW effectively, and scale.

- Consolidators — firms that lose margin share and become attractive acquisition targets for larger players.

- Displaced Entrants — new models that fail to differentiate and are squeezed out.

If you’re planning an exit, your job is to position your company for Group 1 — make the business resilient to software commoditisation and let hardware play to its strengths.

Conclusion

Software hasn’t killed hardware — it reshaped it. Now AI is reshaping software. The companies that succeed will be the ones that combine the physical defensibility of hardware with recurring, AI-enabled services. For entrepreneurs and PE firms, the opportunity lies in positioning, integration and credible plans to defend margins in a faster, AI-driven market.

Whatever you do, think more in terms of hardware going forward.

Feel free to reach out to discuss different matters in the industry.

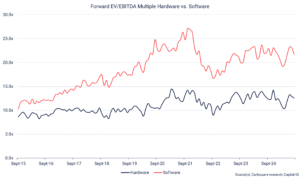

For the record, below are the names of the major stocks in respective index.

Click to zoom