Equity research White Pearl Technology Group: M&A and new business support growth outlook

9 Dec 2025

In recent weeks, White Pearl Technology Group has announced strategically important orders. In addition, the acquisition of Spotr Group portfolio companies has been completed. In summary, the expanding business and strengthened presence in the Nordics support the company’s financial targets, and we subsequently upgrade the valuation range.

New service and products contracts underline strong growth in the Middle East and Africa

On 8 December, White Pearl reported that its subsidiaries, ECC, Cloud, and NDF, have closed systems integration and managed services contracts in Saudi Arabia. Most of the contracts stem from business with governmental entities, and the total value is estimated at over SEK 20 million, of which at least SEK 17.9 million will be recognised in 2026.

Furthermore, White Pearl subsidiary Omnicell has recently announced another NEXUS order for revenue optimisation services from the South African Local Government Association. The contract is valued at SEK 25m in the first phase, covering the next three months. White Pearl expects the project to result in “a multiphase, multiyear engagement” after the initial phase is completed, lasting into 2027.

The contract adds to the tally of wins concerning the proprietary NEXUS platform in 2025, underscoring the rapid growth of both the Digital and Emerging Technologies segments, as well as the group’s overall performance. It also supports the strategic shift toward higher-margin technology solutions (currently accounting for approximately 19 per cent of revenue).

Additionally, White Pearl provides updates on the progress of the cybersecurity business, as well as the Smart Infrastructure segment, including the recently announced acquisition of Premier Brands. It reports recent project wins in South Africa, Burkina Faso, Kenya, and Zambia, estimated at approximately SEK 20m in Q4 2025.

Another acquisition in the Nordics under the belt

Finally, White Pearl has also recently reported that the shareholders of Spotr Group have approved the sale of the company’s portfolio to White Pearl. White Pearl estimates that these companies will add approximately SEK 17 million to their sales and SEK 1.7 million in annual profits. The consideration is SEK 19m in an all-share deal. The rationale is to expand into the Nordics via cloud-based managerial tool Adligo, mobile app development platform Appspotr, the Appspotr organisation of developers and code engineers, and a 51 per cent stake in IT consultant Krobier.

Announced orders make us increasingly confident in financial targets

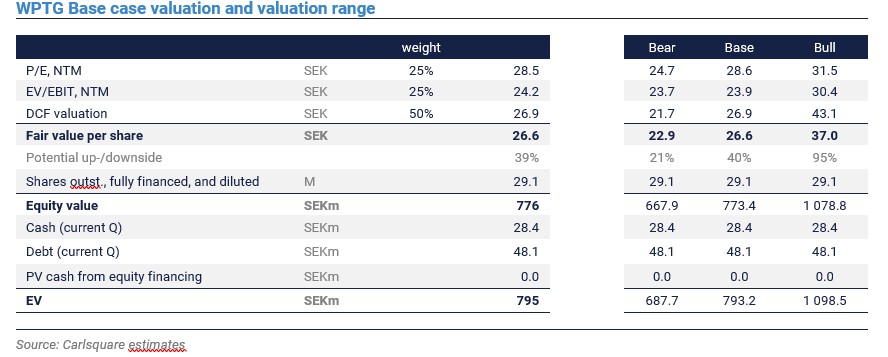

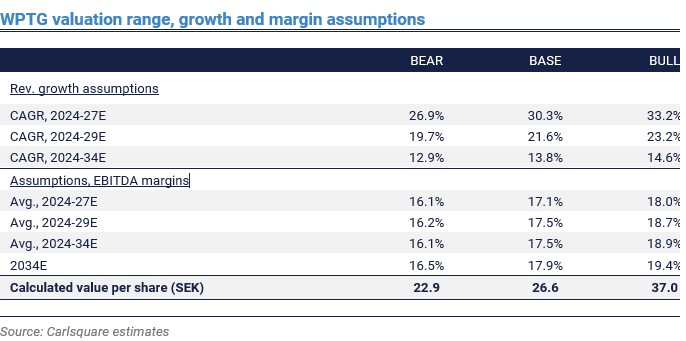

In summary, we believe the news mentioned above suggests strong organic growth in the current quarter, driven by the Africa and Middle East businesses. It should support the previously communicated financial targets, indicating sales of approximately SEK 500 million in FY 2025, as well as solid growth for 2026. Moreover, we believe the possibility of the company upgrading its 2026 target has increased. Overall, we see less risk to our previous estimates and lower the discount rate by about one percentage point. This renders a new base case valuation of SEK 26.6 per share (25).

We also adjust the valuation range per share upwards to SEK 23-37 (from 22-27). Most importantly, for the Bull case, we no longer assume any valuation gap to Nordic peers in the multiple valuation approach (in the base and bear cases, we still apply a 21 per cent discount). The multiple valuation discount is calculated by applying a 30 per cent reduction for emerging markets exposure, multiplied by an assumed 70 per cent weight for White Pearl specifically.

Please read our latest update here.

Disclaimer

Carlsquare AB, www.carlsquare.se, hereinafter referred to as Carlsquare, is engaged in corporate finance and equity research, publishing information on companies and including analyses. The information has been compiled from sources that Carlsquare deems reliable. However, Carlsquare cannot guarantee the accuracy of the information. Nothing written in the analysis should be considered a recommendation or solicitation to invest in any financial instrument, option, or the like. Opinions and conclusions expressed in the analysis are intended solely for the recipient.

The content may not be copied, reproduced, or distributed to any other person without the written consent of Carlsquare. Carlsquare shall not be liable for either direct or indirect damages caused by decisions made on the basis of information contained in this analysis. Investments in financial instruments offer the potential for appreciation and gains. All such investments are also subject to risks. The risks vary between different types of financial instruments and combinations thereof. Past performance should not be taken as an indication of future returns.

The analysis is not directed at U.S. Persons (as that term is defined in Regulation S under the United States Securities Act and interpreted in the United States Investment Companies Act of 1940), nor may it be disseminated to such persons. The analysis is not directed at natural or legal persons where the distribution of the analysis to such persons would involve or entail a risk of violation of Swedish or foreign laws or regulations.

The analysis is a so-called Assignment Analysis for which the analysed company has signed an agreement with Carlsquare for analysis coverage. The analyses are published on an ongoing basis during the contract period and for the usually fixed fee.

Carlsquare may or may not have a financial interest with respect to the subject matter of this analysis. Carlsquare values the assurance of objectivity and independence and has established procedures for managing conflicts of interest for this purpose.

The analysts Niklas Elmhammer and Christopher Solbakke do not own and may not own shares in the analysed company.