Equity research White Pearl Technology Group: Preview , Q3 2025 – Expanding ahead of targets

23 Oct 2025

Read the full research update here:

The preannouncement on 29 September demonstrates stronger sales than we had expected in Q3 2025 and more rapid projected growth for the full year than previously anticipated. Pending the release of the full Q3 report, we expect to raise our base case valuation by 15-20 per cent based on solid growth momentum and raised estimates.

Positive preannouncement supports the investment case

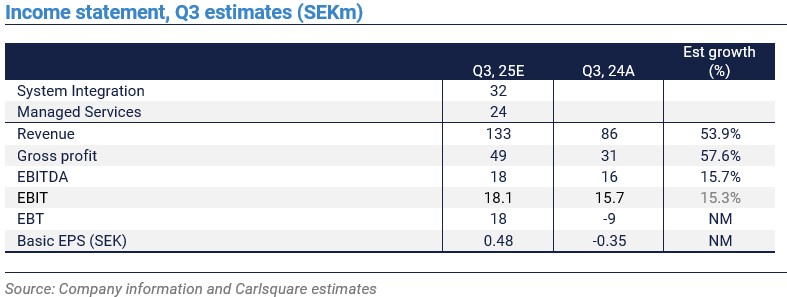

White Pearl Technology Group’s (“White Pearl” or the “Company”) upgraded revenue guidance for Q3 and full year 2025, announced on 29 September, pointed to a 5–10% upside to our previous full year estimate. Q3 revenues of SEK 130–135m imply a ~55% increase, boosted by acquisitions (primarily Lumin4ry) but also stronger organic growth than we had previously assumed. We are encouraged by the positive revision of the full-year estimate, which implies solid development at the back end of the year. According to White Pearl, “the outperformance reflects stronger sales momentum across multiple markets and service lines”. Further, the Company expects to exceed the previous 2026 sales target of SEK 572m. Recently, the company also announced a SEK 33m order for the proprietary AI platform Nexus AI to the UAE market. White Pearl plans to present an updated estimate in conjunction with the Q3 report on 5 November.

White Pearl does not provide updated profitability guidance in the Q3 preannouncement. We assume the EBITDA margin will be diluted from the Lumin4ry acquisition and hence contract in the short term to 13.7 per cent (18.2).

Disclaimer

Carlsquare AB, www.carlsquare.se, hereinafter referred to as Carlsquare, is engaged in corporate finance and equity research, publishing information on companies and including analyses. The information has been compiled from sources that Carlsquare deems reliable. However, Carlsquare cannot guarantee the accuracy of the information. Nothing written in the analysis should be considered a recommendation or solicitation to invest in any financial instrument, option, or the like. Opinions and conclusions expressed in the analysis are intended solely for the recipient.

The content may not be copied, reproduced, or distributed to any other person without the written consent of Carlsquare. Carlsquare shall not be liable for either direct or indirect damages caused by decisions made on the basis of information contained in this analysis. Investments in financial instruments offer the potential for appreciation and gains. All such investments are also subject to risks. The risks vary between different types of financial instruments and combinations thereof. Past performance should not be taken as an indication of future returns.

The analysis is not directed at U.S. Persons (as that term is defined in Regulation S under the United States Securities Act and interpreted in the United States Investment Companies Act of 1940), nor may it be disseminated to such persons. The analysis is not directed at natural or legal persons where the distribution of the analysis to such persons would involve or entail a risk of violation of Swedish or foreign laws or regulations.

The analysis is a so-called Assignment Analysis for which the analysed company has signed an agreement with Carlsquare for analysis coverage. The analyses are published on an ongoing basis during the contract period and for the usually fixed fee.

Carlsquare may or may not have a financial interest with respect to the subject matter of this analysis. Carlsquare values the assurance of objectivity and independence and has established procedures for managing conflicts of interest for this purpose.

The analysts Niklas Elmhammer and Christopher Solbakke do not own and may not own shares in the analysed company.