Equity research CDON AB, Q3 2025: On track for continued growth

24 Oct 2025

Read the full research update here:

Following the positive preannouncement in September, the full Q3 2025 report confirmed the return to growth with increased EBITDA margin, as expected. Marketing expenses remain high, but a stronger e-commerce market, growth initiatives and improved OPEX efficiency are encouraging signs ahead of Q4 2025 and next year. We raise the base case valuation somewhat.

Profitable growth in line with preannouncement

In Q3 2025, Gross Merchandise Value (GMV) and net sales increased by eight and seven per cent, respectively. This outcome was broadly in line with our expectations and the growth level conveyed in the preannouncement on 18 September. The EBITDA margin improved markedly to 10.5 per cent (5.2) due to higher sales and lower OPEX, confirming the previously reported trend of profitable growth in July and August.

The focus for Q4 is on preparing for holiday demand and launching partnerships with new major European merchants. In Q3, CDON reported significant progress in onboarding these partnerships with a unified merchant API. However, they have not yet contributed to sales.

Market tailwind and increased supply likely to bolster sales

As previously reported, the strategic review initiated in April 2025 concluded in a directed SEK 45m share issue to help accelerate growth initiatives, with the aim of an EBITDA uplift of more than SEK 50m from 2027. The four highlighted areas include increased expansion/penetration in the Nordics outside Sweden, investment in engineering capacity, marketing of the group’s brand, and increasing ad revenue through retail media. Total size and distribution of the investments are yet to be determined, but CDON hints that the implementation is a priority for next year in order not to unduly interfere with the seasonally strong Q4. We have assumed a mix of increased marketing expense, OPEX and investments for 2026. All in all, we believe CDON may have to increase GMV by some 20+ per cent to achieve its 2027 EBITDA target. We think this is achievable through, e.g, increased supply. Already, this is ongoing with the mentioned onboarding of new major European home electronics merchants in H2 2025 and the relaunch of a snus vertical in Q4 (to address a market worth SEK 10.6bn in Sweden alone). Further, CDON recognises a market tailwind, as also reflected in the solid growth reported by several Swedish e-commerce retailers recently.

Encouraging development, pending more details on growth plans

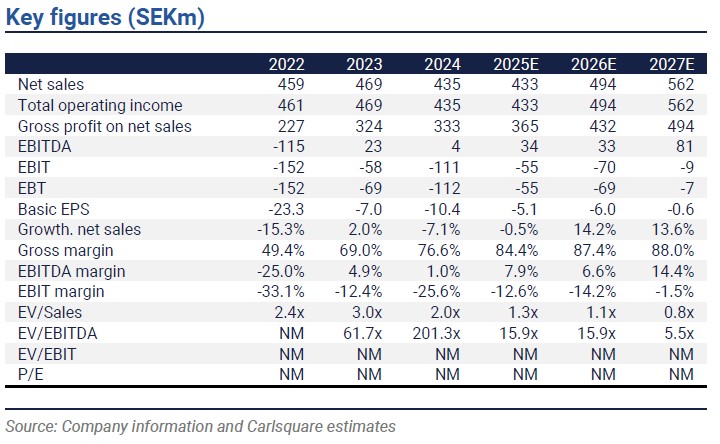

We believe the Q3 outcome supports our view of returning growth based on macro trends, and the organisation having shifted to initiatives to increase supply and improve customer experience, after an extensive organisational and technological integration in 2024. For 2026, there are still limited details regarding expected costs/investments related to, e.g. marketing and further technology development. Hence, our earnings estimates for next year are somewhat uncertain at this stage. However, the recent capital raise provides leeway. We make minor adjustments to our estimates and raise the base case valuation slightly.

Disclaimer

Carlsquare AB. www.carlsquare.se, hereafter referred to as Carlsquare, conducts operations in Corporate Finance and Equity Research and thereby publishes information about companies, including analyses. The information has been compiled from sources that Carlsquare considers reliable. However, Carlsquare cannot guarantee the accuracy of the information. Nothing written in the analysis should be regarded as a recommendation or invitation to invest in any financial instrument, option or similar. Opinions and conclusions expressed in the analysis are intended solely for the recipient.

The content may not be copied, reproduced, or distributed to any other person without the written consent of Carlsquare. Carlsquare shall not be liable for any direct or indirect damage caused by decisions made based on information contained in this analysis. Investments in financial instruments provide opportunities for capital appreciation and profits. All such investments are also associated with risks. The risks vary between different types of financial instruments and combinations thereof. Historical returns should not be considered as an indication of future returns.

The research is not directed at U.S. Persons (as that term is defined in Regulation S of the United States Securities Act and interpreted in the United States Investment Companies Act 1940) and may not be distributed to such persons. Nor is the analysis aimed at such natural or legal persons where the distribution of the analysis to such persons would involve or entail a risk of violation of Swedish or foreign law or regulations.

The analysis is a so-called commissioned analysis where the analysed company has signed an agreement with Carlsquare for analysis coverage. The analyses are published continuously during the contract period and against customary fixed remuneration.

Carlsquare may or may not have a financial interest in the subject of this analysis. Carlsquare values ensuring objectivity and independence and has therefore established procedures for managing conflicts of interest.

The analysts Niklas Elmhammer and Markus Augustsson do not and may not own shares in the analysed company.