Equity research Viva Wine Group, Q2 2025: No market tailwind but support from Delta acquisition

11 Aug 2025

Viva Wine Group (the company or Viva) will release its Q2 2025 report on 28 August 2025. Below are Carlsquare Equity Research’s updated estimates ahead of the report.

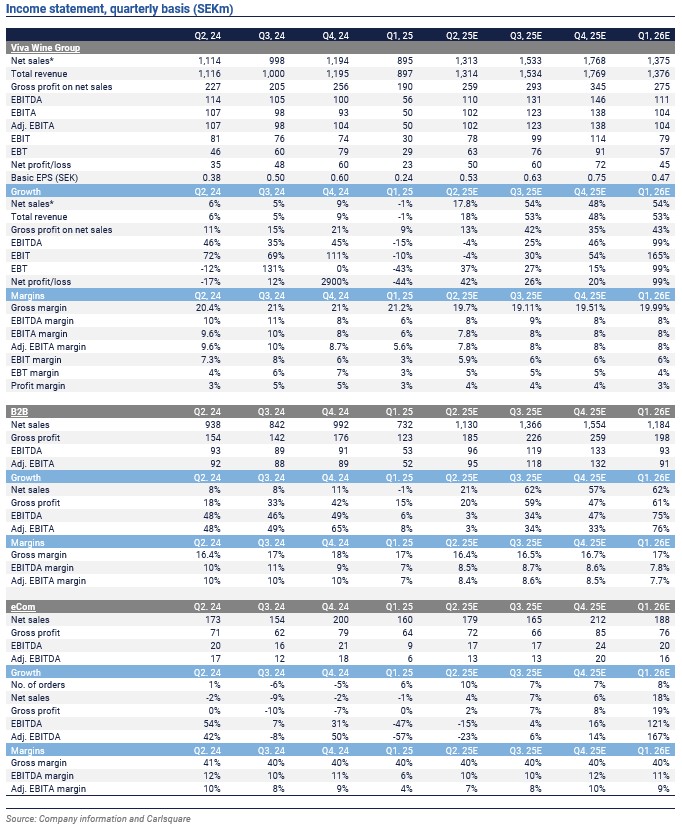

- The second quarter was challenging in the Nordic monopoly markets despite the late Easter positively affecting sales volumes in April. Likely exacerbated by the cool weather, we estimate that the overall Nordic market (volumes) declined somewhat in Q2 2025. Hence, the volume pick-up vs. Q1 was less than we had initially expected.

- In Sweden, the comparison to last year is difficult since the market share in Q2 2024 was temporarily elevated due to logistics problems for competitors. To conclude, we expect volumes to have been lower for Viva Wine Group in the recent period, roughly in line with the market. However, we gauge that year-on-year effects from previous price adjustments should support a return to slight growth in the Nordics despite the headwinds mentioned above.

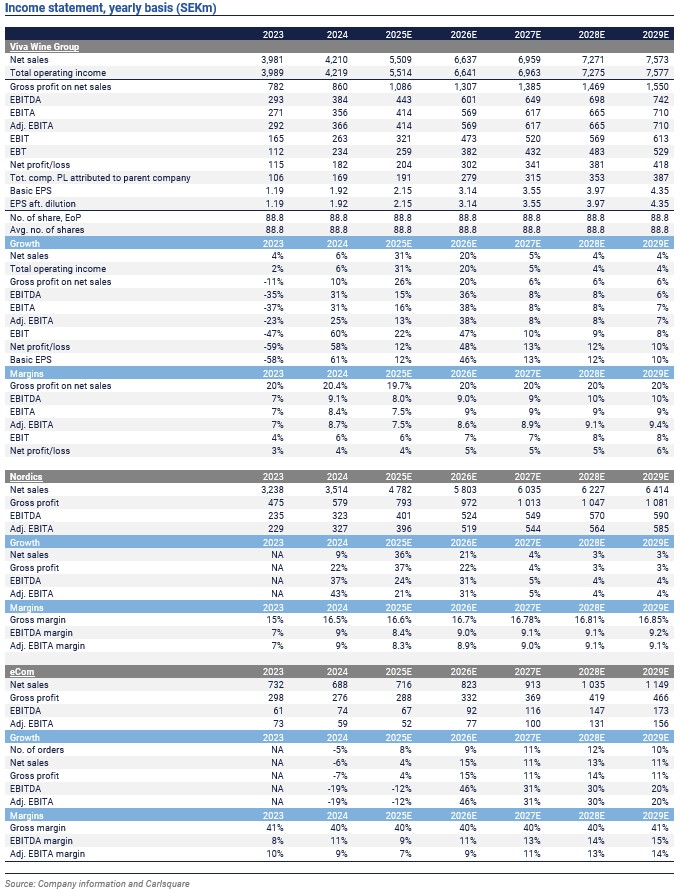

- In May, Viva announced the acquisition of Delta Wines, the leading B2B wine distributor in the Netherlands. As a result, the Netherlands will become the second-largest geographical market for Viva Wine after Sweden. Viva has indicated that Delta is expected to boost group sales by some 50 per cent. We expect a significant contribution to the B2B segment (previously: Nordics) in the quarter of about 18 per cent.

- We remain optimistic of some growth for the e-commerce segment in the quarter, based on what appears to be decent development for the German e-commerce market in the quarter and marketing initiatives from Viva to expand the customer base and spur growth. However, we note that German peer Hawesko reported a sales decline in its e-commerce and retail segments in the second quarter, which is a bit concerning.

- As a result of slower monopoly markets than previously anticipated, we revise our total net sales estimate for Viva Wine Group, including the Other segment and eliminations, in Q2 2025 downwards to SEK 1,314m (from SEK 1,362m previously), corresponding to slightly below 18 per cent growth.

- As we still have limited financial data around Delta, our forecast is uncertain. We expect Delta to be dilutive to margins as it faces a different market structure compared to the monopoly markets in the Nordics. We have not included any one-off costs. All in all, we assume a slight decline in operating profit year-over-year. For the group, we expect an adjusted EBITA of SEK 102m (107), corresponding to a margin of 7.8% (9.6).

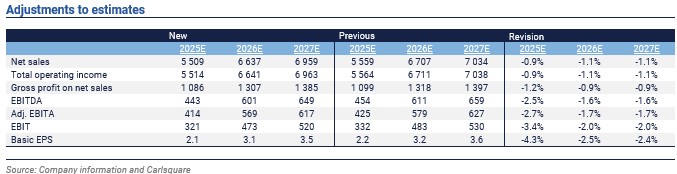

- Overall, we have become somewhat more cautious regarding organic growth for the full year due to weaker markets than expected in the Nordics and a more stable market share. We believe this has some impact on margins as well. Hence, we adjust our earnings estimates lower by about two per cent overall. We will review our current base case valuation of SEK 54 per share in conjunction with the Q2 report.

Read the latest research update here.

Disclaimer

Carlsquare AB, www.carlsquare.se, hereinafter referred to as Carlsquare, is engaged in corporate finance and equity research, publishing information on companies and including analyses. The information has been compiled from sources that Carlsquare deems reliable. However, Carlsquare cannot guarantee the accuracy of the information. Nothing written in the analysis should be considered a recommendation or solicitation to invest in any financial instrument, option, or the like. Opinions and conclusions expressed in the analysis are intended solely for the recipient.

The content may not be copied, reproduced, or distributed to any other person without the written consent of Carlsquare. Carlsquare shall not be liable for either direct or indirect damages caused by decisions made on the basis of information contained in this analysis. Investments in financial instruments offer the potential for appreciation and gains. All such investments are also subject to risks. The risks vary between different types of financial instruments and combinations thereof. Past performance should not be taken as an indication of future returns.

The analysis is not directed at U.S. Persons (as that term is defined in Regulation S under the United States Securities Act and interpreted in the United States Investment Companies Act of 1940), nor may it be disseminated to such persons. The analysis is not directed at natural or legal persons where the distribution of the analysis to such persons would involve or entail a risk of violation of Swedish or foreign laws or regulations.

The analysis is a so-called Assignment Analysis for which the analysed company has signed an agreement with Carlsquare for analysis coverage. The analyses are published on an ongoing basis during the contract period and for the usually fixed fee.

Carlsquare may or may not have a financial interest with respect to the subject matter of this analysis. Carlsquare values the assurance of objectivity and independence and has established procedures for managing conflicts of interest for this purpose.

The analysts Niklas Elmhammer and Markus Augustsson do not own and may not own shares in the analysed company.