Research update Risk Intelligence, Q1 2023: Good growth but below our expectations

23 May 2023

Read the full research update here:

Equity Research Risk Intelligence

In Q1 2023, Risk Intelligence increased important recurring system revenue by 12% to 15.8 MDKK. However, this was below our expectations. Net sales were lifted by consulting revenues while profitability is weakening. We adjust forecasts and estimate a fair value of DKK 3.8 per share (5.7) for the coming 6-12 months. The valuation requires growth to accelerate.

Revenue above expectations but ARR and ARPU lagging behind

In Q1 2023, Risk Intelligence’s net sales increased by 17% to DKK 5.1m. This was above our forecast of DKK 4.9m. Net sales were lifted by consulting revenues, e.g., from the collaboration with DeepOcean. Important total recurring system revenue (total system ARR) increased by 11.8% to DKK 15.8m. This was below our forecast of DKK 17.1m. Also, both total system ARR and total average revenue per client (ARPU) declined sequentially (compared to Q4 2022). We consider this somewhat worrying as we had expected a positive sequential growth for both KPI:s since DSV and DHL were signed as new customers for land-based solution. However, the company’s estimate of ARPU for clients on the land-based solution remains at DKK 425,000. This gives hope for a fast future growth in total ARPU and ARR as more clients sign up for the land-based solution.

On a yearly basis, contract was cancelled with one customer. This corresponds to a low churn of 0.8%. In parallel, the revenues from the existing customer base continues to increase in line with the company’s strategy. That is demonstrated by the NRR which reached 105%. However, the cost base also increased, by 19%, which is partly explained by increased activity in sales and marketing. This also weighed on the reported EBITDA result, which came in at minus 1.6 MDKK. We had expected an EBITDA result of minus DKK 1.4 million. With reported investments of about 0.5 MDKK, the free cash flow ended up at minus 2.5 MDKK and at the end of Q1 2023 the cash amounted to 0.3 MDKK. Finances are thus still under pressure, which adds a layer of risk.

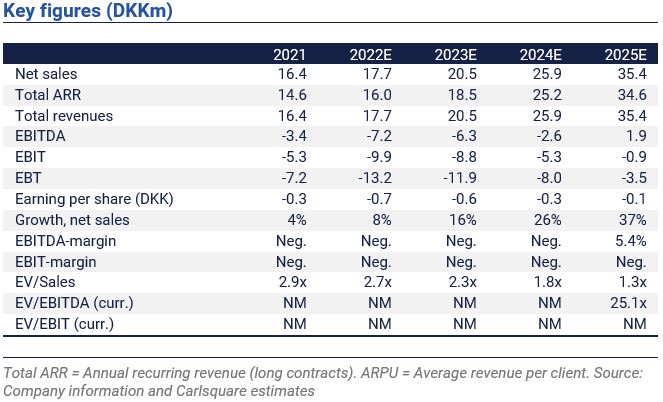

In anticipation of an increase in revenue

In addition to the important agreements with DSV and DHL, the company’s focus on commercial partnerships has borne fruit. The company expects these partnerships to provide a revenue boost by the end of this year. The company’s target for System ARR remains in the range of 18.5-20.9 MDKK until the end of 2023. ARR and ARPU must increase and in 2023 we model with net sales increasing to 20.5 MDKK. Over the period 2023-2027 we expect a CAGR of 25.9%. We expect positive EBITDA to be reached in 2025 and until 2027 we have assumed that the EBITDA margin rises to 21.6%.

Reduced fair value but potential upside remains

In a base case scenario, a fair value of DKK 3.8 per share (DKK 5.7) is calculated. The downward revision is explained by lower valuation multiples among peer companies and lower revenue forecasts and margin assumptions. Our valuation corresponds to EV/Sales NTM of 4.3x, a 38% discount to the reference group (information systems and SaaS companies). Today, the stock is trading at a valuation of 2.3x our revenue forecast NTM and 3.0x last reported System ARR.

Disclaimer

Carlsquare AB, www.carlsquare.se, hereinafter referred to as Carlsquare, conducts business with regard to Corporate Finance and Equity Research in which areas it, among other things, publishes information about companies including analyses. The information has been compiled from sources that Carlsquare considers to be reliable. However, Carlsquare cannot guarantee the accuracy of the information. Nothing written in the analysis should be regarded as a recommendation or invitation to invest in any financial instrument, option or the like. Opinions and conclusions expressed in the analysis are intended only for the recipient.

The content may not be copied, reproduced or distributed to another person without the written approval of Carlsquare. Carlsquare shall not be held responsible for any direct or indirect damage caused by decisions made on the basis of information contained in this analysis. Investments in financial instruments provide opportunities for value increases and profits. All such investments are also subject to risks. Risks vary between different types of financial instruments and combinations of these. Historical returns should not be considered as an indication of future returns.

The analysis is not directed to U.S. persons (as defined in Regulation S of the United States Securities Act and interpreted in the United States Investment Company Act 1940) nor may it be disseminated to such persons. The analysis is also not directed to such natural and legal persons where the distribution of the analysis to such persons would result in or entail a risk of a violation of Swedish or foreign law or constitution.

The analysis is a so-called Commissioned Research Report where the analysed Company has signed an agreement with Carlsquare for analysis coverage. The analyses are published on an ongoing basis during the contract period and for a usual fixed remuneration.

Carlsquare may or may not have a financial interest in the subject of this analysis. Carlsquare values the assurance of objectivity and independence and has established procedures for managing conflicts of interest for this purpose.

The analyst Markus Augustsson and Christopher Solbakke does not own and is not allowed to own shares in the Company analysed.